At $55.57, the average monthly revenue per mobile user grew along with the subscriber number, and that contributed to the half a billion in extra revenue in the Mobility department.

AT&T Q1 performance

AT&T’s CEO John Stankey patted the team on the back for the discipline in executing the cost savings and revenue generation strategy :

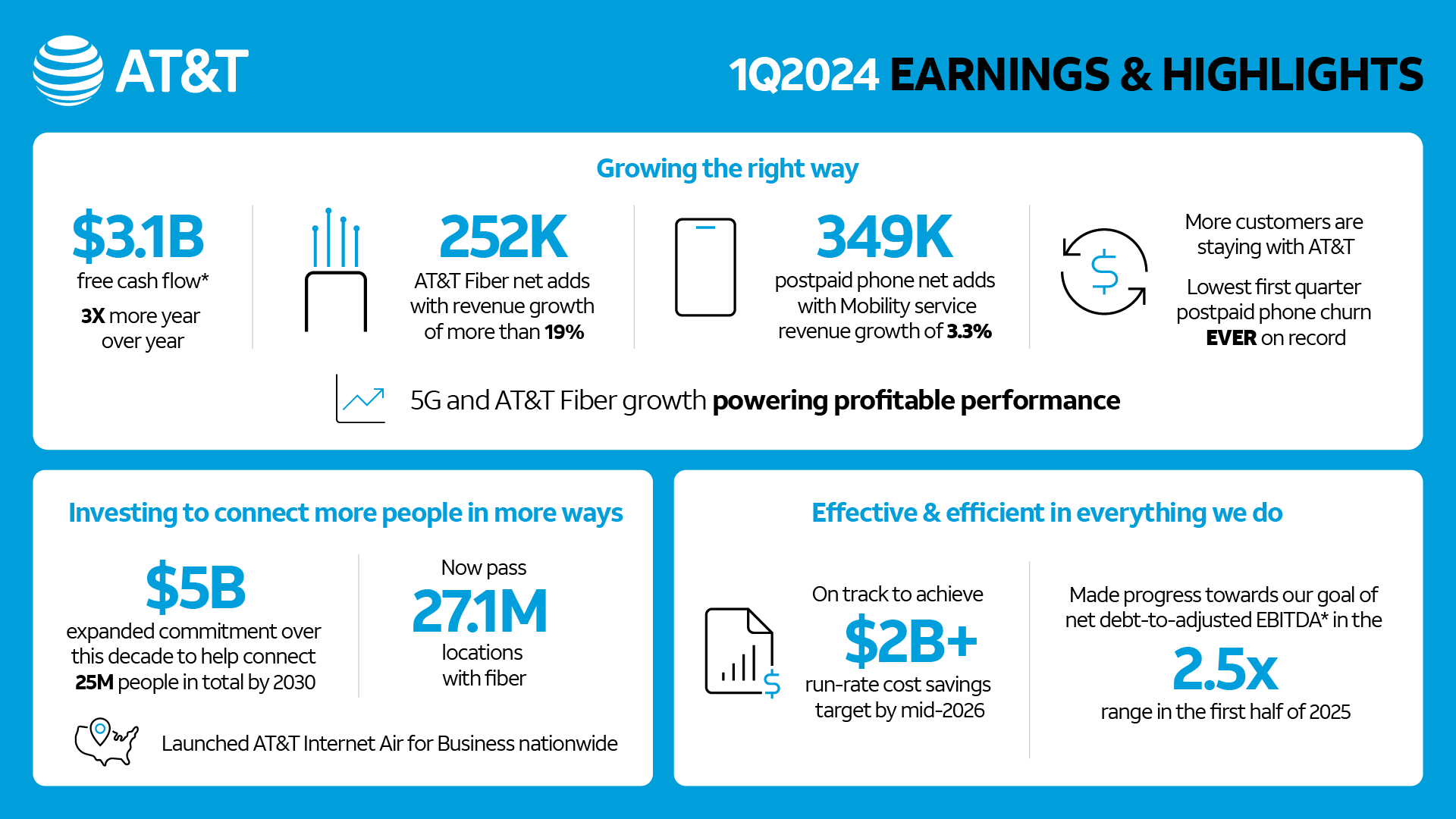

Our results this quarter reflect continued strong growth in our Mobility and Consumer Wireline connectivity businesses, which represent about 80% of our total revenues. Customers are choosing AT&T and staying with us. We achieved a record-low first-quarter postpaid phone churn, grew consumer broadband subscribers for the third consecutive quarter, and expanded margins in Mobility and Consumer Wireline. We’re also delivering on our commitment to grow and improve the quality and cadence of free cash flow, which increased by more than $2 billion year over year. This consistent, solid performance driven by our investment-led strategy gives us confidence to re-affirm our full-year consolidated financial guidance.

As a result, AT&T notcher “lower equipment revenues due to lower sales volumes” of phones and tablets. Users are now also upgrading much more rarely than before, keeping a phone for three years instead of the two in the era of contracts. That is why AT&T introduced the 36-month equipment installment plan and the others quickly followed.

What we are most interested at, however, are AT&T’s capital expenditure plans for the expansion of its 5G network and services. AT&T spent $3.8 billion on network upgrades in Q1, with plans to spend at least $21 billion for the year, as it now prioritizes 5G and fiber as its “long-term growth” factors.