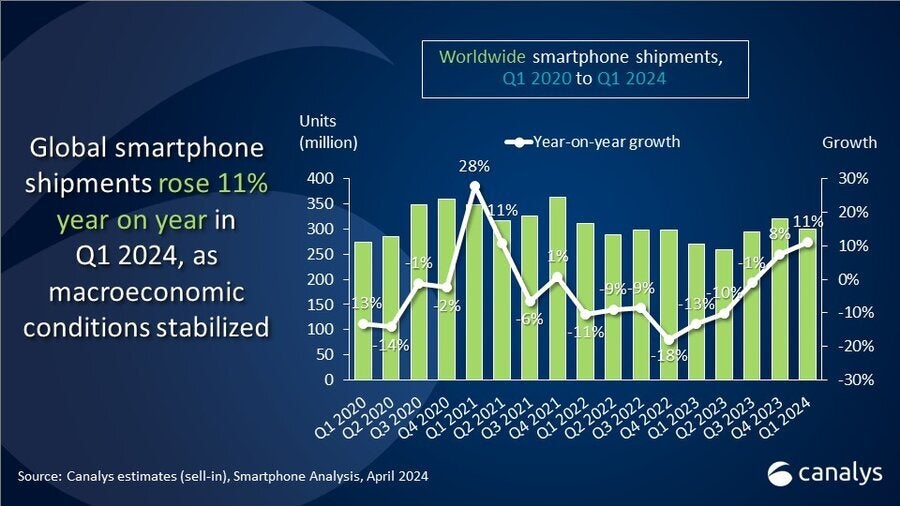

The global phone market doldrums of the past two years are now over, with

shipments increase to nearly 290 million units in the first quarter of the year alone, yet iPhone sales are down. The market has taken Samsung for a ride, though, and it is now back at the top as the world’s largest phone maker.

In the previous quarter, following the

iPhone 15 release, it was Apple that managed to beat Samsung to the

top phone maker place, but only by a fraction of a percent. With the

Galaxy S24 release, and after Apple’s weak first quarter in

China, Samsung’s lead is now with a much larger margin.

The “rise” of Samsung is the norm

In a 290-million Q1 market, Samsung now commands 20.8% market share, according to IDC, taking the top spot from Apple, while riding on the wings of the Galaxy AI marketing it embarked on with the S24 series launch.

Another market research firm,

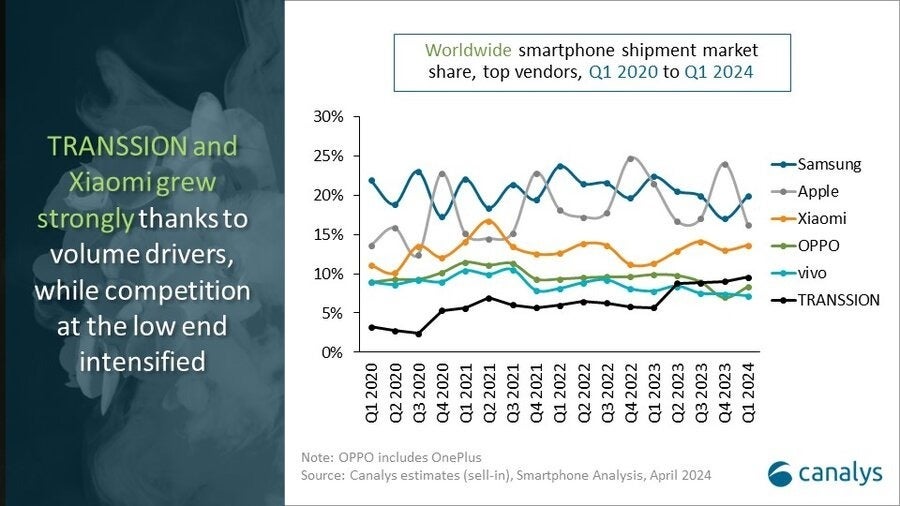

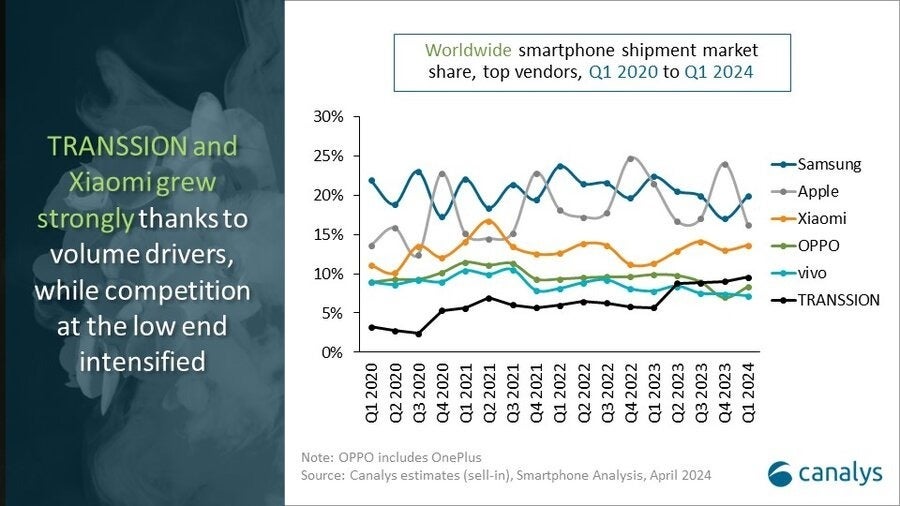

Canalys, has similar observations about the shifts in global phone market share in Q1, putting Samsung at the top with 20%, and Apple second at 16%.

Samsung’s own ambitious Q1

target of 55 million shipments for the mobile division was not only met, but actually surpassed by a huge margin, with 64.5 million phones and tablets sold, via a rather significant boost in the shipments of the S24 series, especially the

Samsung Galaxy S24 Ultra.

Samsung regained its smartphone market share crown thanks to the commercial success of its new

Galaxy S24 series that come with many AI-powered features that we, as reviewers, as well as users in general, found rather useful and with added value. The

Galaxy AI features offer smooth translation in real time, Chat Assist,

Circle to Search, and other notable new features powered by on-device AI that Samsung partnered for with Google.

Nevertheless, Samsung’s 20% or 20.8% market share, according to Canalys or IDC, is actually down compared to its 22% in the same quarter last year when it announced and released the

Galaxy S23 series.

Thus, there isn’t some sort of huge rebound and success story around the Galaxy S24 as the quarter-on-quarter numbers would suggest, even though Samsung seems a bit more resilient than Apple at the moment. According to Nabila Popal, research director at IDC:

The smartphone market is emerging from the turbulence of the last two years both stronger and changed. Firstly, we continue to see growth in value and average selling prices (ASPs) as consumers opt for more expensive devices, knowing they will hold onto their devices longer. Secondly, there is a shift in power among the Top 5 companies, which will likely continue as market players adjust their strategies in a post-recovery world. Xiaomi is coming back strong from the large declines experienced over the past two years, and Transsion is becoming a stable presence in the Top 5 with aggressive growth in international markets. In contrast, while the Top 2 players both saw negative growth in the first quarter, it seems Samsung is in a stronger position overall than they were in recent quarters.

Apple’s “slump” is hardly an exception

According to many headline grabbing reports, on the other hand, Apple’s iPhone sales “slumped” significantly in the first quarter, and it is way behind Samsung in terms of shipments now, with 17.3% market share.

This was explained with the rise of the Chinese juggernauts that continued unabated. There is more to that story, though, as the Chinese government and companies started restricting the use of Apple gear, while patriotic fervor boosted sales of local brands like Huawei with its homebrew Kirin chipset.

Xiaomi is now the world’s third-largest phone maker with 14% share with a number of low-cost offerings, followed by the rising Oppo and OnePlus, as well as other local industry stalwarts like Transsion, which sells a bunch of budget models in Africa, and is now the top vendor there. That trend has been going on for a while, though, and the

iPhone 15 vs S24 virtues have little to do with it.

The Q4 rise in Apple sales and the subsequent “slump” where Samsung takes over is historically the norm, rather than the exception that is made out to be. As can be seen from this handy graphic by Canalys, Apple rides on the wings of a new iPhone announcement each last quarter of the year.

Historical Apple vs Samsung market share trends

Samsung, which in recent years switched to Q1 releases of its flagship phone series, gets a huge sales boost three months after Apple for rather self-evident reasons, and climbs back on top.

Unlike Apple, it is able to smooth out its market share curve because it has a second big launch of

foldable phones in Q3, and also sells a bunch of midrangers and budget models that Apple wouldn’t bother with. When Cupertino announces its financials for the previous quarter, it would probably be laughing all the way to the bank still, as the average selling price of its iPhones is much higher.

In short, Apple always bounces in Q4, and Samsung in Q1, so it would be a bit premature to think that the Galaxy has left the iPhone in the dust following Apple’s struggles in China.

Everyone seems to have sales problems there, but that is because phones coming from Oppo, Xiaomi, or Huawei, are now rivaling and often even surpassing those of the Apple-Samsung duopoly in terms of specs and features.