Concept render of a clamshell foldable iPhone. } Image credit-Unknown

So you thought the foldable segment of the smartphone industry was printing money. According to Display Supply Chain Consultants (DSCC), during the third quarter of 2024, shipments of foldable displays declined year-over-year for the first time ever. And this is not expected to be a short-term shortfall either as DSCC says to expect a small annual 5% rise in foldable display shipments this year to be followed up by a 4% decline for all of 2025. That’s after the delivery of foldable displays grew by 40% per year from 2019-2023.

Some of the declines in shipments of foldable displays are taking place against the backdrop of some manufacturers pulling out of the foldable market. As we told you last month, besides little known budget names like Infinix, Itel, and Tecno waving the white flag, a bigger name out of China is expected to pull out as well. Either vivo or Oppo, both owned by China’s BBK Electronics (along with OnePlus, Realme, and iQOO), could be saying goodbye to foldables.

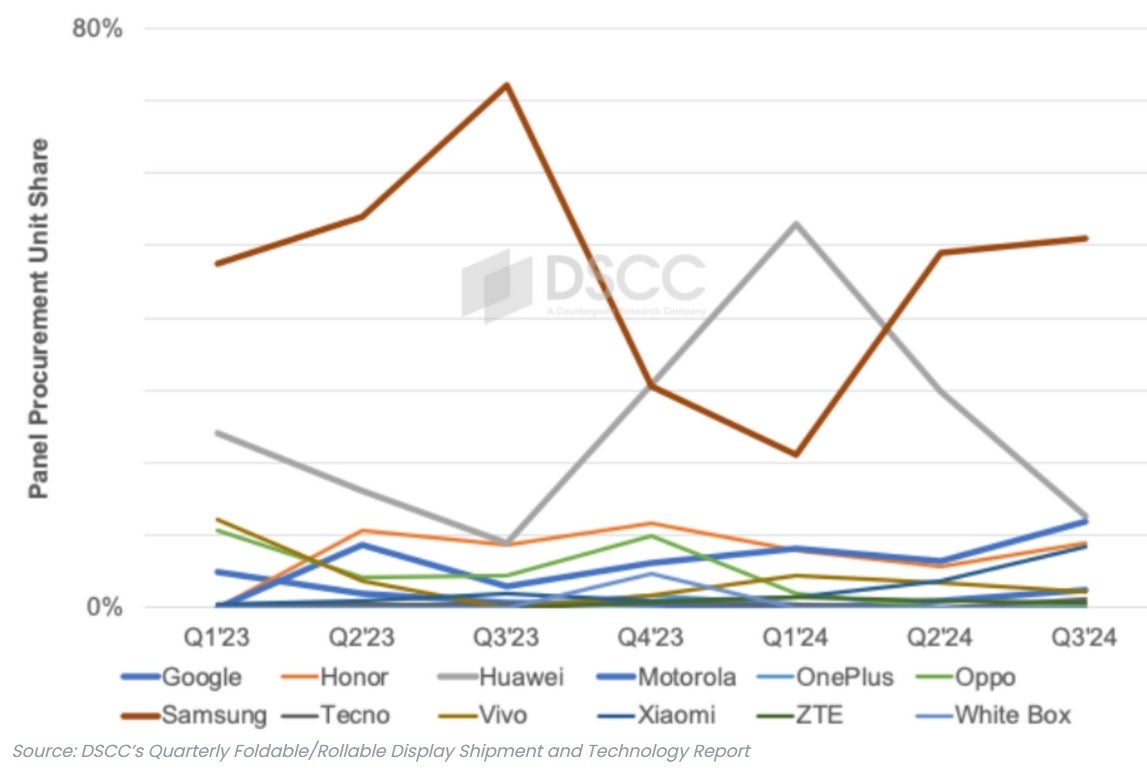

Samsung led the way in foldable panel procurement for the third quarter of 2024. | Image credit-DSCC

Right now, Samsung and Huawei are the two leaders in the global foldables market. DSCC says that display shipments for the Galaxy Z Flip 6 clamshell foldable this year will be 10% below the number shipped for the Galaxy Z Flip 5 last year. While demand for the device has been strong in Europe and Korea, it hasn’t caught on in the U.S. and China. And this is big news since the Galaxy Z Flip 6 will be the top-selling foldable in 2024. The Galaxy Z Flip 5 (2023) and Galaxy Z Flip 4 (2022) also received that honor.

Even though panel shipments for the Galaxy Z Fold 6 will outnumber deliveries for the Galaxy Z Fold 5, Sammy’s overall foldable panel shipments for 2024 will be down 20% to the lowest level since 2021. Things would have been worse had Samsung not accepted panels this quarter for a model not coming until 2025. Samsung still leads the way in foldable panel procurement as the manufacturer receives 40 out of every 100 foldable panels shipped, down from 52% last year. DSCC sees Samsung’s procurement market share rising back over 50% in 2025 on over 20% growth. The numbers will still be below the 2022 and 2023 figures.

Huawei’s foldable panel procurement has also declined from 30% of the market in Q2 to 20% in Q3. Even with less than expected panel shipments for the tri-fold Mate XT, Huawei will post an improvement of more than 90% in the procurement of foldable displays with its share rising from 18% in 2023 to 33% in 2024.

Based on panel procurement figures, the top 10 foldable smartphones during the third quarter included:

- Three foldable phones from Samsung including the Z Flip 6 leading with a 31% share, and two other models.

- Huawei and Motorola each with a pair of foldable phones on this list.

- One model each from Google, Honor, and Xiaomi.

Is there anything on the horizon that can turn around this suddenly moribund foldable market? Here comes Apple to save the day. With its first foldable expected to hit the market during the second half of 2026, DSCC expects that year to deliver record-setting growth for foldables with 30% growth followed by 20% growth in 2027 and 2028.

DSCC forecasts that one other brand will ship a tri-fold in 2026. However, DSCC also sees the number of players in the foldable market continuing to decline. In 2024, 41 different foldable models shipped and DSCC sees that number declining to 32 next year.