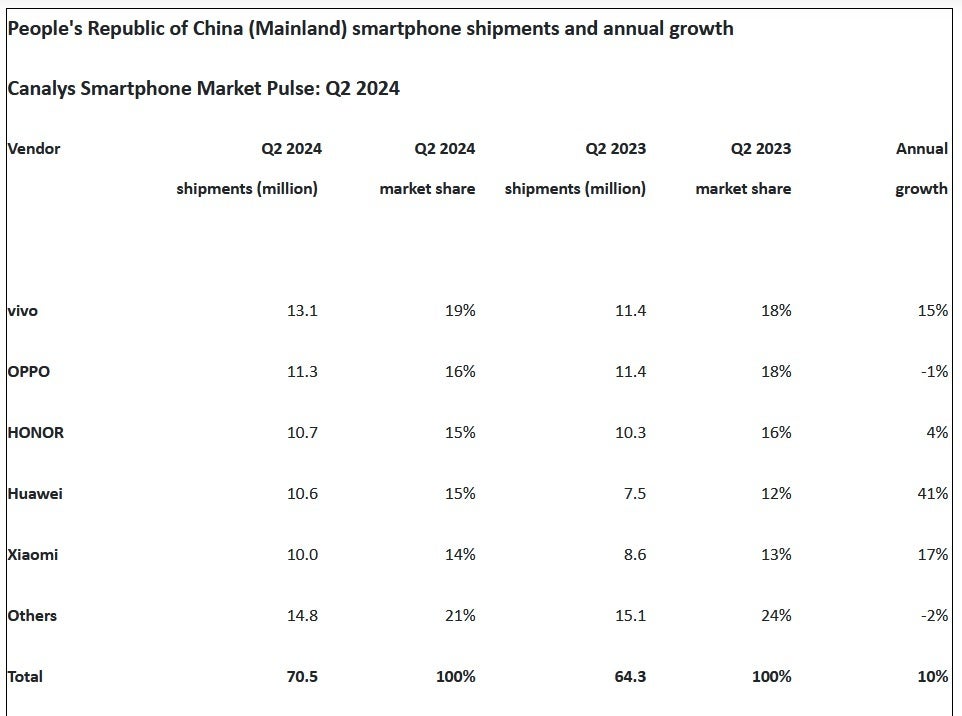

For the first time in history, the top five smartphone manufacturers in China during a quarter were all domestic firms. | Image credit-Canalys

The top smartphone manufacturer in China during the second quarter was Vivo. One of the Chinese smartphone brands owned by BBK Electronics, Vivo shipped 13.1 million handsets during Q2 giving the company 19% of China’s market during the three months ended in June. That worked out to a 15% year-over-year increase in shipments for the company. BBK’s stablemate Oppo was next after 11.3 million units were delivered during the quarter, down 1% on an annual basis. Oppo had 16% of China’s smartphone market during Q2.

“The growth in the second quarter signals a gradual market normalization, but we still expect a modest single-digit recovery for the year. Three key trends will impact the market landscape in the second half of 2024. Firstly, the market will be closely watching Huawei’s upcoming launch of HarmonyOS Next, as the vendor aims to position it as a third major mobile OS alongside Android and iOS. Additionally, local players are investing in AI infrastructure, developing in-house models, and creating AI applications as key competitive advantages to disrupt the high-end segment. Lastly, the intense domestic competition is also driving overseas expansion, with Chinese brands expected to achieve new milestones in international markets throughout the rest of 2024.”-Toby Zhu, Canalys Senior Analyst

Rounding out the iPhone-less top five was Xiaomi with 10 million handsets delivered in China during the quarter. That was a 17% increase on an annual basis giving Xiaomi a 14% share of the Chinese smartphone market during the second quarter.

Second-quarter smartphone shipments in China reached 70.5 million units, a 10% gain from the 64.3 million delivered during the same quarter last year.