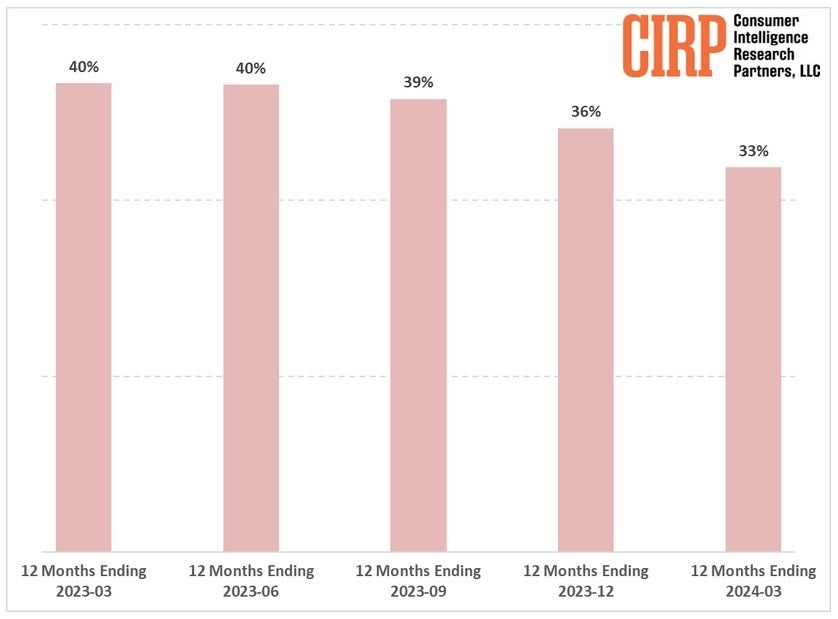

The iPhone’s share of new phone activations in the U.S. has been declining. Starting with the 40% share that the device had over the 12 months that ended in March 2023, the iPhone accounted for only 33% of new U.S. phone activations during the 12 months that ended in March 2024. That share has turned back the clock six years when the iPhone battled against not only

Android phones but also had to compete against Windows Phone and BlackBerry-powered handsets.

Having the iPhone account for one in every three phone activations in the U.S. isn’t historically low according to

Consumer Intelligence Research Partners, LLC (CIRP). The latter claims that the iPhone’s 33% share brings U.S. smartphone activations back to “the historic level of about one-third iPhone, two-thirds Android.” Besides what it says is a return to the norm, CIRP also has other reasons to explain the recent decline in Apple’s share.

Apple’s share of new phone activations in the States has been declining

The report says that the combination of increased durability and fewer new features has resulted in smartphone owners, especially those owning an iPhone, waiting longer to upgrade. Also helping this trend was the move from two-year subsidized contracts to financed phone payment plans.

Explaining why it uses trailing 12-month data to make quarterly comparisons, CIRP said, “We estimate 12-month periods ending each quarter, using our quarterly survey of mobile phone customers. This allows us to capture all phone activations, rather than just Apple iPhone, and looking at trailing 12-month periods eliminates seasonality caused by new phone launches, gift giving, etc.”

While

Apple and Android manufacturers add new features or upgrade the specs on their phones every year, it hasn’t been enough to return the upgrade cycle closer to two years. The good news for phone manufacturers, including Apple, is that this has created a large pool of phone buyers who are just waiting for that killer new feature or app to give them the reason to pull the trigger on the purchase of a new phone. For some, the expanding use of AI-powered features on new Android and iPhone models could be the incentive.

Outside of the nerdiest of phone nerds and the biggest phone enthusiasts, very few consumers upgrade every year-or even every two years-for the latest camera technology or the fastest new chipset produced with the most current process node. Many consumers wait until their phone no longer works before buying a new one. And as CIRP pointed out, the durability of smartphones is on the rise while the vast majority of phone financing deals lock you into a 36-month contract.